When you see WeWork burning $1.9 billion in operating losses in 2018 (on total sales of $1.8 billion) and Uber losing almost $10 billion in the three years before its IPO, it is easy to forget that turning a profit is a goal for 99.99% of businesses. For those readers who have spent too much time in the “internet bubble,” the term “profit” is an old-fashioned notion where a company aspires to increase the difference between the amount it generates as income and the amount it spends.

Thankfully for investors, not every tech-enabled business plans on losing money forever. And some companies start to generate profits fairly early on. In my 5th installment of La Escuela del Sur, I reviewed the common corporate holding structures used by Latin American entrepreneurs to organize their businesses and raise money.

Those structures can be refined further to optimize for tax efficiency when a business is expected to generate profits early in its growth cycle. As the adage says “It’s not what you make. It is what you keep that matters.” With tax rates sometimes in excess of 50%, any entrepreneur growing regionally should consider how to balance tax efficiency with a proper business structure.

International tax planning can optimize a company’s goal of generating tax-efficient returns, while still creating a corporate structure that will be attractive to traditional venture fund investors.

These are the questions that many of our clients at PAG.law ask about international tax structuring. We believe that knowledge should be free so we will happily share our general thoughts. That being said, this type of analysis is by definition very fact intensive and any specific recommendation requires the analysis of international tax treaties, the categorization of streams of income, and lots of detailed analysis well beyond the scope of this article. We are not providing any tax or other advice through this general interest article.

“I have a great problem: My Latin American operations are generating positive cash flow. How should I properly manage the tax burden?”

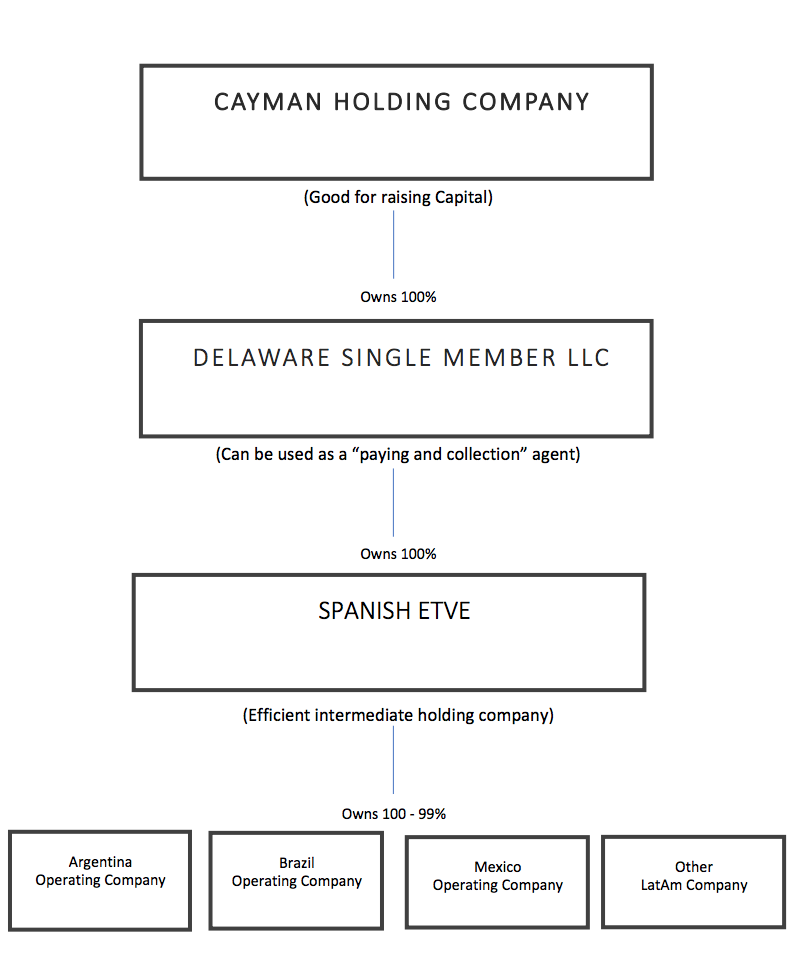

By far the two most popular intermediate holding companies to own profitable companies across Latin America are the Spanish ETVE (Entidad de Tenencia de Valores Extranjeros) and Dutch holding companies (NLs or CVs).

The simple reason behind this popularity is that Spain has the largest network of tax treaties with Latin American countries and The Netherlands is often considered a close second. Tax advisers sometimes point out the Dutch tax treaty with Brazil as even more favorable than Spain’s. However, many clients find that Dutch entities are costly to administer and the regulatory and administrative issues are greater than those costs related to a Spanish ETVE.

A Spanish ETVE is considered a Spanish resident company. Therefore a Spanish ETVE benefits from Spain’s wide network of tax treaties and avoids double taxation while receiving reduced withholding taxes.

An ETVE’s local tax exemption covers dividends and capital gains derived from its ownership in non-Spanish entities. Other than that, ETVEs are considered to be normal taxable entities in Spain. Therefore ETVE’s are not efficient to use as a billing and collection agent for the operations of its subsidiaries.

“Why do companies like Google and Apple use jurisdictions like Ireland or Scotland?”

We regularly receive questions about what Google and Apple have done by setting up operations in jurisdictions like Ireland. Most clients do not realize that Google and Apple have over 7,000 and 6,000 employees in Ireland respectively. Most international tax treaties require a real local presence.

Unless a company is willing to set up real operations in a country, that country’s tax treaties are not applicable. Spain and The Netherlands are viewed as having very simple and attainable local presence requirements.

Some companies can spend tens of millions of dollars in international tax planning and save literally billions in taxes, but that is not the reality for most entrepreneurs in Latin America. (Also worth remembering that Apple in 2018 paid $14.8 billion in back taxes and interest to Ireland.)

“Some of my customers are reluctant to pay my local subsidiaries in Brazil, Mexico or Argentina. How can we create a “billing and collection” agent for my company’s LatAm operations?”

For a variety of reasons some international clients resist paying a local Brazilian, Mexican or Argentine entity. Latin American companies that want to bill international clients from outside of their home countries often create a single owner/single member US limited liability company (an LLC) that has little or no “US source income/US effectively connected income” (ECI).

There are complicated “transfer pricing rules” that international tax experts need to consider before setting up an LLC or any paying and collection agent. That said, a US LLC would often charge a fee (usually 2-6% of the amounts billed and collected) to its affiliates via an inter-company agreement. This fee would compensate the US LLC for the efforts related to the billing and collecting of monies from clients/customers of an affiliated entity in Latin America.

The US LLC may be able to deduct some of its expenses against any fees it charges to its affiliated entities. As such, sometimes the US tax burden on the US LLC is quite low or even zero. The real benefit is that international customers can pay a US entity’s bank account in the United States, rather than paying a local operating company in Latin America.

“Should I just use the Spanish ETVE or Dutch entity as the ultimate parent company and raise money with that entity?”

As we have written previously (see here) if the goal of an entrepreneur is to be able to raise capital from traditional VC or PE fund investors, there are only two real alternatives for the holding company: (i) a Delaware C-Corp (highly tax inefficient, but 100% accepted) or (ii) a Cayman company (highly tax efficient, but some investor resistance). There are precious few examples of Spanish ETVEs or Dutch holding companies raising capital from traditional venture capital funds.

Often we get asked about whether a Delaware partnership or Canadian limited partnership might make for a good holding company to raise capital. The issue with a partnership as a holding company is that most venture and private equity funds will not invest in partnerships (or partnership-like entities like an LLC or a Dutch Coop that are “transparent” for tax purposes). This resistance is because funds themselves generally are set up as partnerships or otherwise “transparent” for tax purposes.

The concern is that the fund is also transparent for tax purposes. If a fund invests in another “transparent” entity, then the fund will be directly attributed the income of the entity it invested in. The investors in the fund, often known as limited partners (LPs) don’t want to get a tax bill for “phantom income” of an investment that the fund made in some downstream company.

What structures might best balance my company’s interest of tax efficiency while still being able to raise capital?

For the reasons suggested above, we often suggest clients discuss the structures below with their international tax advisors.

My father likes to say “Free advice is usually worth what you paid for it”.

While this article hopes to focus your thinking about tax regulation, it cannot replace the need for a deep dive with experts on the related tax and regulatory issues surrounding international tax planning. Let’s remember that most Latin entrepreneurs will need to spend tens of thousands of dollars to properly structure an efficient international holding and billing structure for their growing cross-border company.

Good luck and go make some money. And then do some good international tax planning.

This post is also available in: Español (Spanish)

1 comment

Great article!