If you are in self-quarantine, Gabriel García Márquez’s amazing novel Love in the Time of Cholera might help pass the time. If you are an entrepreneur it’s time you read Sequoia Capital’s letter to its portfolio companies “Coronavirus: The Black Swan of 2020”.

I began losing my hair in the 2000s, during the burst of the first dot com bubble. In March of 2000 we sold Patagon.com to Banco Santander for too much money, had hundreds of employees we were responsible for and needed hundreds of millions of dollars to implement our business plan.

The day we sold Patagon.com the Nasdaq composite index was at above 5,000. Six months later the Nasdaq composite was at half that value. In March 2010—a decade after we sold Patagon.com—the Nasdaq was still only at HALF of its all-time high. 10 years and still a 50% loss for the Nasdaq composite…

Sequoia, in its letter, gives great advice—but advice that your grandmother would give you. Safeguard your cash, sell more, spend less and finding more money won’t be easy. Wonderful, but let’s remember, that advice will help get companies through a year of tough times.

But what if there is a paradigm shift? What if we experience, as we did in the 2000s, 10 years of limited capital and 10 years of lack of exits? If real tough times are upon us, we have to change the way we think. We can’t “just tighten the belt” for a few months.

First, we have to stop thinking that Silicon Valley will save us. It is great that SoftBank has been signing some big checks in LatAm. However, if times really get tough, international investors will refocus on the winners in their portfolios and their local entrepreneurs. The TecnoLatino will get a much, much smaller piece of the Silicon Valley investment pie.

Second, we cannot assume there will be endless amounts of capital coming into our tech-enabled companies. So, we may have to start creating companies that would make attractive acquisition targets for the local economic groups that dominate our economies in LatAm.

Let’s keep in mind that local economic groups will buy companies for between $2M-25M. To put that in perspective, in the United States most exists are between $25M-250M. We can only build what a buyer will pay for…

Third, we may have to accept that angel investors will change their funding model. Gone may be the days where a “seed round” in Latin America involves raising $250K-750K for start-ups and near start-ups.

We may learn that less is sometimes more—less money can often lead to more creativity. (We all know in Latin America that it is often the people with the least money who are the most “creative”.)

I am encouraging entrepreneurs to think what they could build with a seed round of $50K-100K. In venture, we tend to forget that $100K is a lot of money—almost an unimaginable amount of money in LatAm, where middle-class people live on $1K a month. We need to be willing to ask ourselves: Why can’t our tech-based companies reach breakeven with $100K—if they have a business model that makes sense?

As I said in 2000, when the dot.com bubble burst, and as I said in 2009 after Lehman Brothers blew up: when I first rode the subway in New York City by myself, my mother only gave me one piece of advice. “If you realize you are heading in the wrong direction, you need to get off that train and get on a train that is heading in the direction towards where you want to go.”

Old-timers like me waited almost 10 years from 2000 for there to be a reasonable flow of venture capital activity back into the LatAm region. There is a reason why I lost my hair waiting for the venture market to come back.

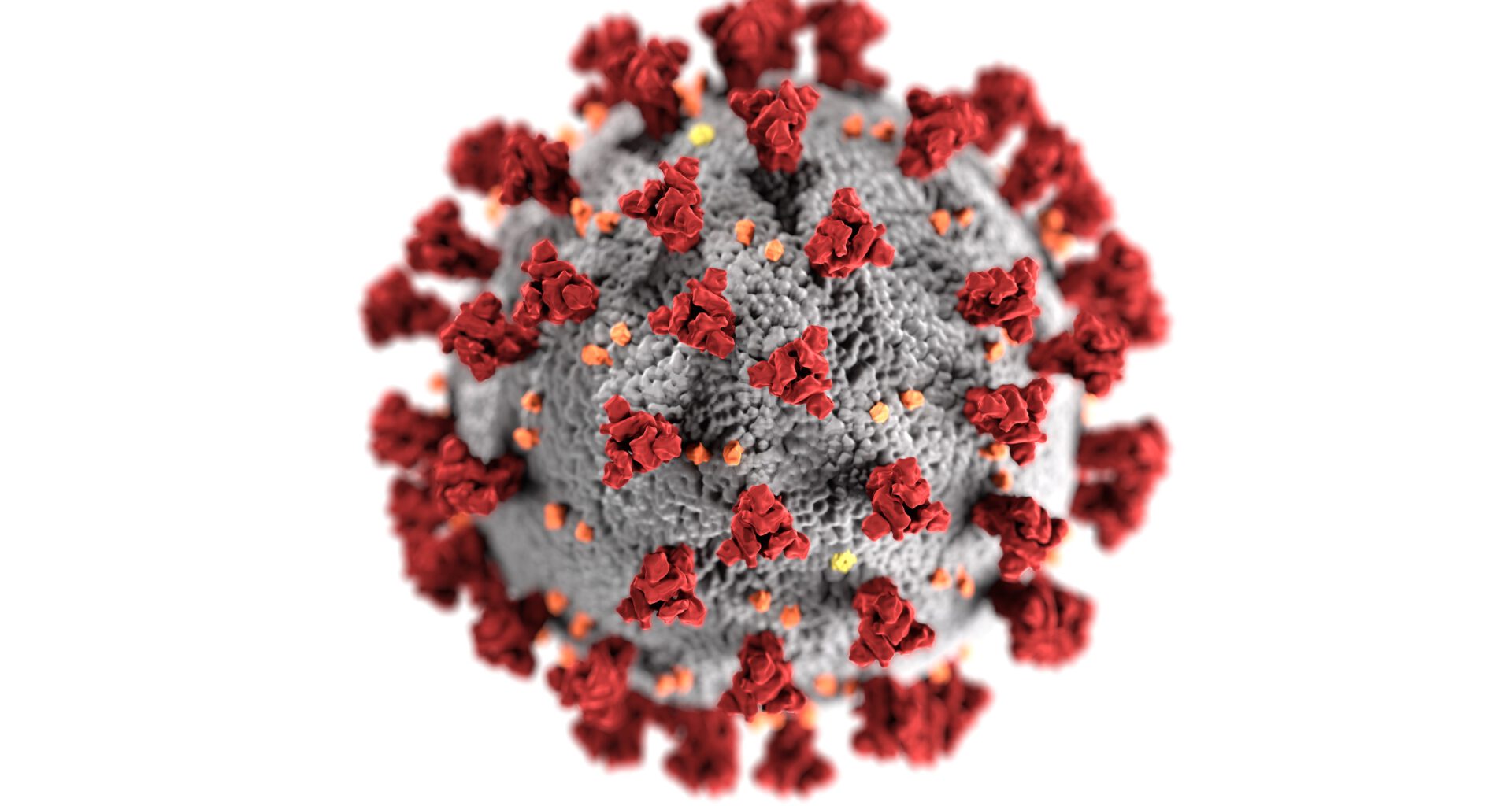

Just as we can continue to write amazing love stories in times of cholera, we can continue to build great companies even in the time of COVID. But we should be prepared to change the stories we have been writing and the companies we have been building.

Juan Pablo Cappello is Co-Founder of PAG.law and can be reached at [email protected].

Check out La Escuela del Sur, a series of columns he wrote as a part of our partnership to promote Latin American entrepreneurs.