LatamList – ePesos, a Mexican fintech that allows employees to instantly gain access to funds, announced $21M in debt financing from Accial Capital, a private debt investor for tech-enabled startups in emerging markets.

Jared Miller, CEO of Accial Capital, stated that investing in ePesos’ portfolio will allow thousands of families in Mexico to regularize their incomes and achieve a greater economic recovery, especially in the current COVID-19 context.

ePesos will use this investment to continue financing and developing the platform which is committed to supporting companies and their employees in Mexico for free. With ePesos, companies can help their employees with unforeseen expenses without having to resort to loans or credits that may push them into uncontrollable debt.

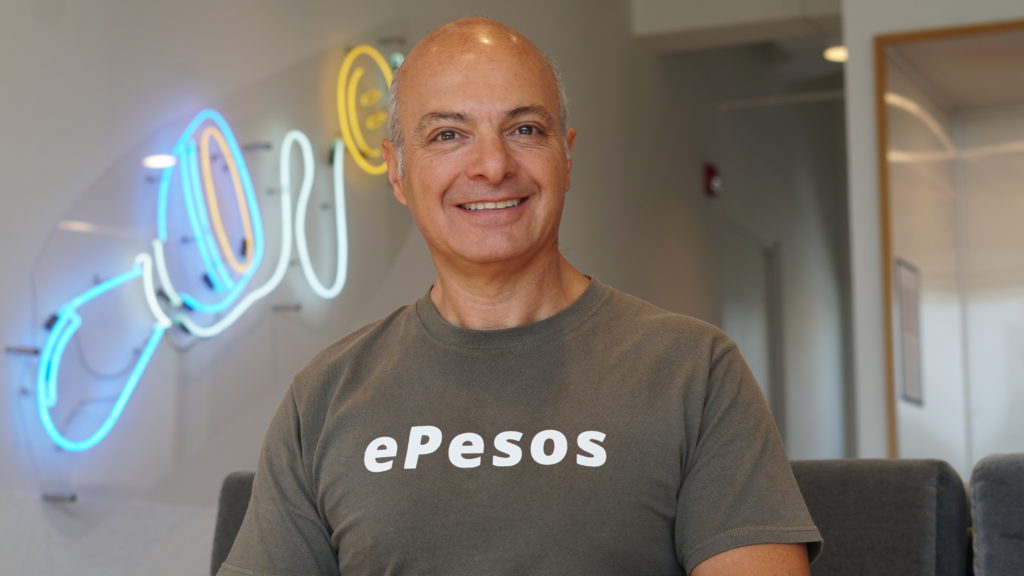

“We realized that today more than ever, we need benefits that are truly focused on the employees, that is why we decided to go one step further and develop ePesos+ (ePesos plus),” commented Oscar Robles, CEO of ePesos.

ePesos+ will help Mexico’s unbanked sector, as well as people that have had problems with the credit bureau, gain access to credit.

“Only 15% of employees have access to formal credit, forcing many to recur to pawn shops or informal lenders,” added Robles.

With ePesos+, employees can get net salary advances of up to three months with a service charge of up to 38% yearly, repaid within 12 months.