El Salvador-based fintech n1co raised a $18 million seed-round from regional groups. The payments startup seeks to position itself as the first neobank in Central America.

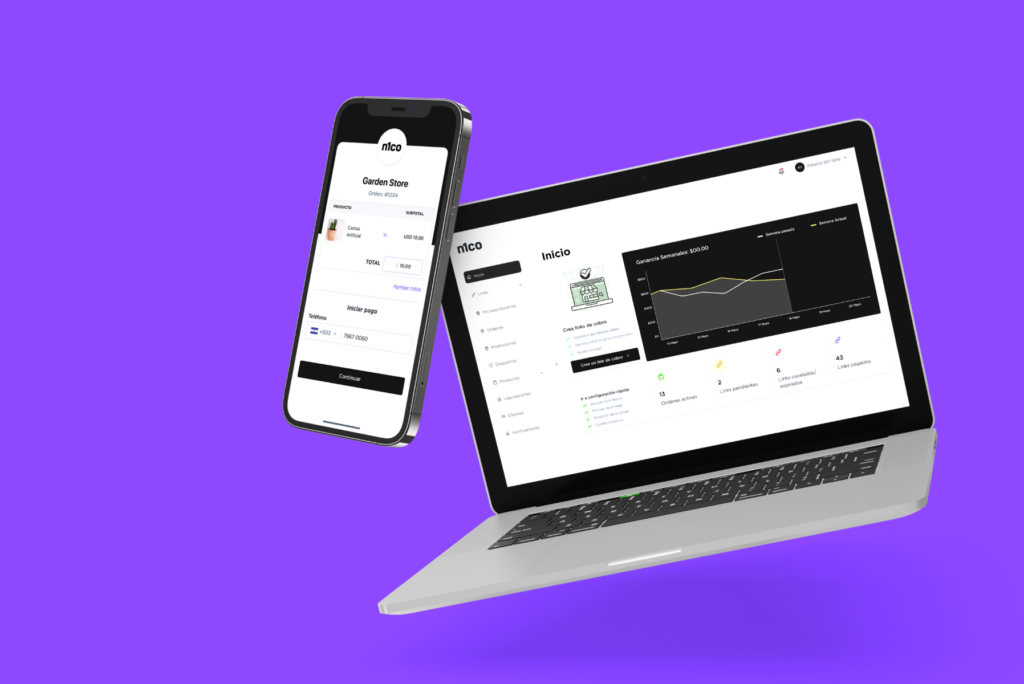

The n1co fintech allows small and large businesses to accept any type of card, whether credit, debit, links or QR codes and create their own online store, even with the option of home delivery. The platform also offers links to make product payments easier and simpler.

“We are focused on building a neobank that contributes to reducing the financial gap in the region, integrating more people into the banking system. In that line, we will launch several financial products that will aim at this goal, while we continue working to offer simpler transactions for our users,”

said in a press release Alejandro McCormack, COO and executive director of n1co.

n1co began operations in April 2022 and currently has an affiliate network of more than 1,000 businesses in El Salvador, Honduras and Guatemala. With a monthly growth of 30%, they expect to close 2022 with a monthly processing value of more than $4.5 million at the regional level.