LatamList – NovoPayment, a leading banking-as-a-service platform and Visa Inc., the world’s leader in digital payments, recently announced the launch of a white-label solution called Prepaid in a Box.

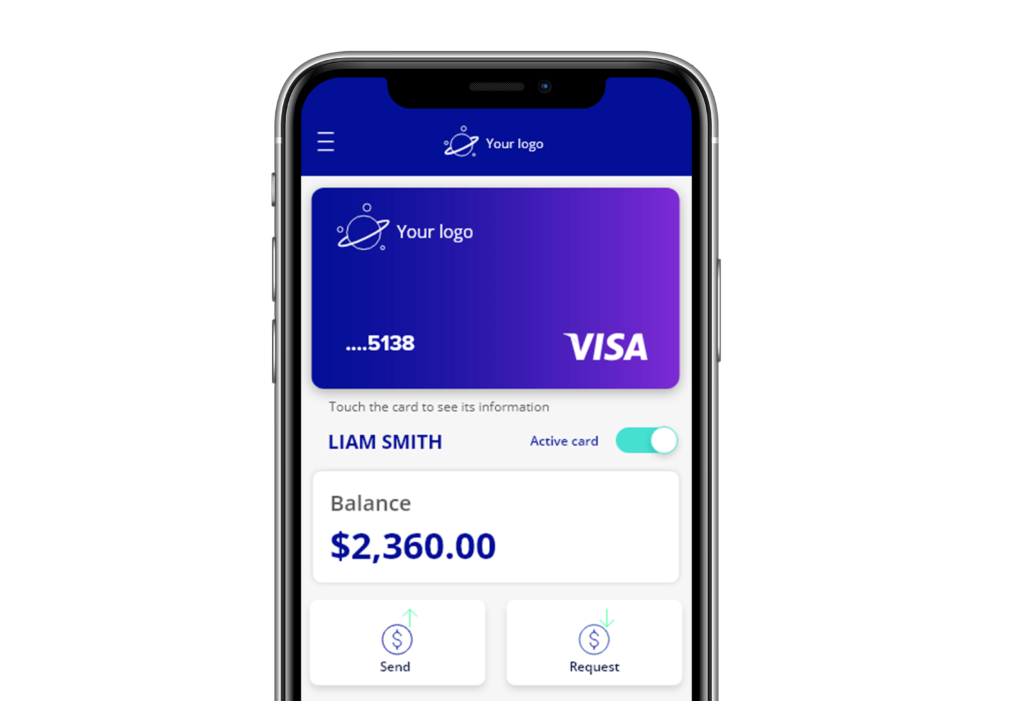

The solution, which is the result of a collaboration between the two companies, provides issuers the ability to deploy instant virtual accounts and disbursement programs in as little as 10 weeks. The platform offers configurability by country and will help accelerate the transition to fully digital delivery models in Latin America and the Caribbean.

“Our combined vision couldn’t have come to reality at a more relevant time,” said Anabel Perez, co-founder and CEO of NovoPayment of the partnership between the two companies adding, “Prepaid in a Box embodies our philosophy of accelerating and enabling digital payments, breaking many barriers for issuers of all sizes via our combined enablement of digital banking, payments infrastructure and card solutions.”

The platform enters the market with two initial use cases. The first use is the instant issuance of virtual accounts to address current obstacles with accelerating online and other non-present transactions.

The second use of this solution is remittance and disbursement. Governments in the region are set to spend more than $94B in COVID-19 related stimulus and aid, for which they need fast and reliable disbursements. This platform helps streamline the delivery of funds, for example originating from family abroad or local government aid, to banked and unbanked individuals.

“As we begin the path to recovery in our markets, it is important to focus on the relevance of digital inclusion. Where consumers who are transacting for the first time online or receiving government subsidies or remittances from abroad, regardless of them being banked or unbanked, have the ability to be part of the digital economy – which has seen an exponential acceleration in the last few months,” said Ricardo Tafur, Head of Consumer Payments for Visa Latin America and the Caribbean.

Key platform features for both consumers and issuers include self-enrollment, instant issuance, enhanced security features, all required interfaces, and complete installation and configuration of Visa issuing services, among other solutions.

Read more on this press release or on their website.