There’s confusion around what legal structures make sense for Latin American startups. Founders, VCs and even lawyers can make decisions that can cost upwards of $100M if you get it wrong.

This post is the result of investing in 80+ startups from 15+ Latin American countries since 2014 via Magma Partners, and speaking to and working with countless lawyers across LatAm, US, UK, Europe and multiple offshore jurisdictions. I wrote a version of this that I’ve been sharing with Magma Partners founders internally and decided to open source it with the hope that founders save themselves time and money and make themselves more investable.

There are fairly clear outlines that most Latin American startups should likely follow. Every startup’s case is different, and each founder should get legal advice from a lawyer and tax advice from an accountant with relevant US and Latin American venture capital experience before following this guide or anyone else’s ideas.

To be clear, this is not legal or tax advice. You should always work with a lawyer and accountant when thinking about corporate structures. The money you’ll spend getting good advice will save hundreds of thousands or even hundreds of millions of dollars down the road. I can’t stress this enough. Don’t just follow these guidelines. Your situation is unique. Talk to an experienced lawyer and accountant.

Let’s start with a story. Brian Requarth, cofounder of Vivareal and Latitud had a big exit in 2020. His structure cost him and his investors $100M:

In the early days of a startup, money is tight and it’s common to cut corners. I created a California LLC for my company because of my local accountant’s advice. He had zero experience with VC or Latin America.

Later, I hired a my hometown law firm that had no VC experience, which advised me to create a C-Corp, which seemed like good advice at the time.

We later realized that even though our business had no operations in the US, we would be subject to US taxes upon an exit. We had raised VC money and at this point it was cost prohibitive to restructure.

We later merged with our competitors. We retained top lawyers & accountants to help us manage our extremely complex deal. The deal took an unnecessarily crazy amount of time and effort because of our original structure. But we finally came up with a solution we thought worked.

When we ended up selling our combined business to OLX Brasil, we signed a term sheet, but during the due diligence they opted to buy our local entities because they saw our restructuring as a huge risk. We paid millions of dollars to lawyers & accountants to get this deal done.

We finally completed the transaction, but our company paid over $100M to the United States government despite our business having zero revenue in the US.

Via https://twitter.com/brianrequarth/status/1345063197146017798 Lightly edited for clarity.

Brian’s story is only unique in two aspects:

- The $100M in taxes his company paid is really high because he was so successful

- He’s willing to share his story publicly

I know many other Latin American companies that have gone through this nightmare that ended up paying millions of dollars to the US government even though they never had US clients, US operations or even spent time in the US. Or they spent hundreds of thousands or even millions of dollars on lawyers and accountants trying to fix their original structures.

The TL;DR

Don’t be weird

Don’t give investors another reason to say no to investing in your business. Pick one of the structures VCs understand and are comfortable with.

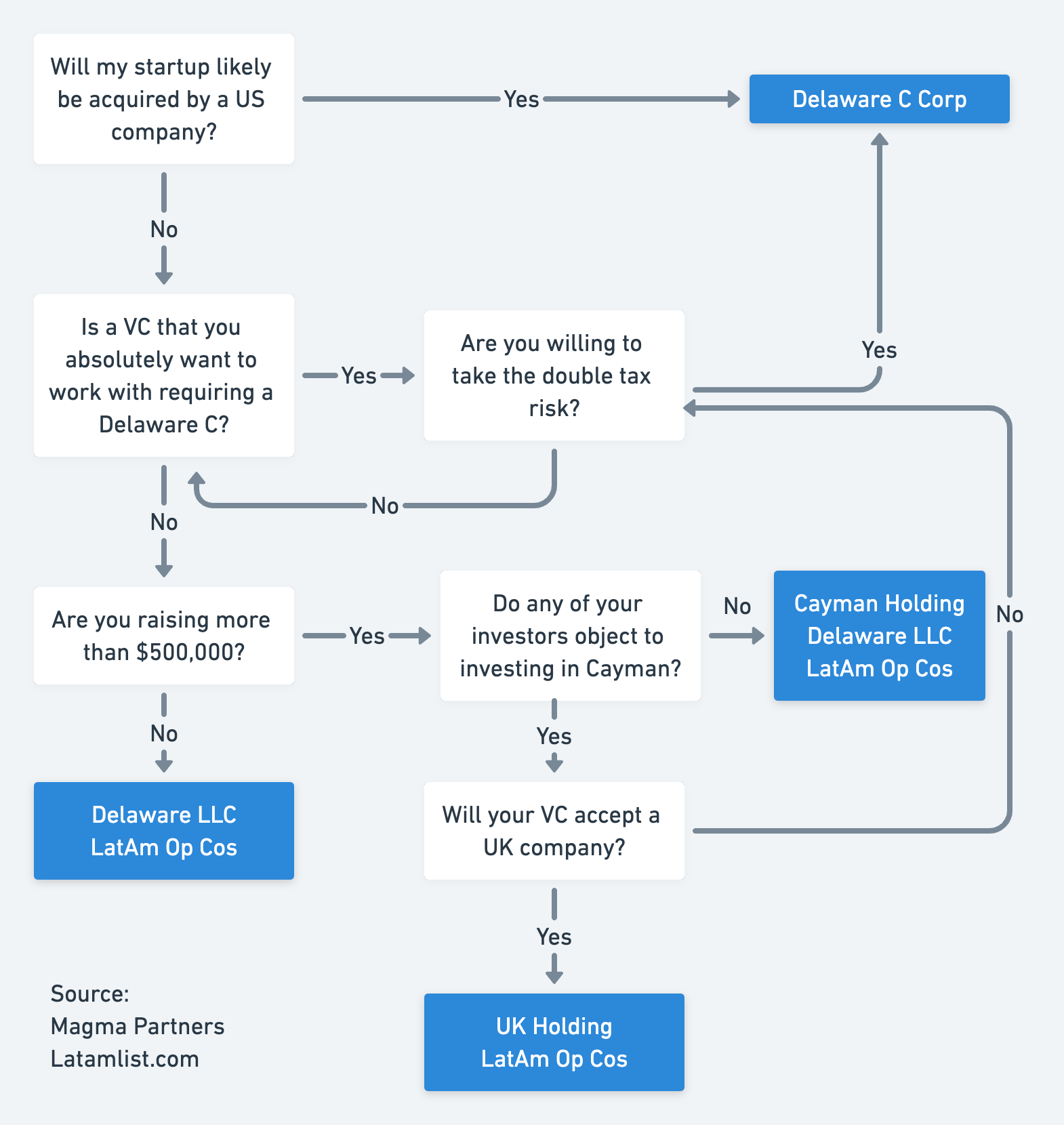

Delaware C Corp if:

Your startup targets the US market, most of your clients are going to be in the US and you think there’s a very good chance you’ll be acquired by a US company. For example, a SaaS or marketplace that targets US clients.

OR

A top tier investor offers you the money and valuation you need to be successful and requires a Delaware C Corp. You are willing to take the risk of 21% double taxation.

Delaware LLC if:

You’re not confident a US company will be your acquirer. You can always convert to a Delaware C quickly, easily and cheaply. You can always add a Cayman or UK holding on top of your Delaware LLC. For example, a LatAm market fintech or insurtech. You are likely raising less than $500,000.

Cayman Limited Holding on top of your Delaware LLC if:

Similar criteria to an LLC, but you are raising significant venture capital or an investor requires it.

UK Company if:

You convince yourself you don’t want a Cayman structure, or an investor doesn’t want Cayman and is ok with UK. You should only use UK when an investor is willing to invest here, otherwise staying as a Delaware LLC as long as possible is likely the best decision.

Double Tax: Why Did Brian’s Company pay $100M to the US Government when he had no operations or clients in the US?

The short answer: you may pay a 21% double tax even if you never have a US client, US operations or even set foot in the US. If you start as a C Corp, “like the Hotel California, you can check in, but you can never leave.”

When a non-US company buys a Latin American company, the buyer will very likely be interested in your local operating companies. They will not likely be interested in your US holding company. They either have their own local entities, or their own non-US structures.

They will buy the assets of your US company, or they will buy the local entities in each country. In Brian’s case, they bought the Brazilian entities. Since the Delaware C Corp owned the Brazil entity, the money flowed back to the Delaware C Corp and which was a profit for the C Corp.

Delaware C Corps pay 21% corporate tax on profits, and then they can distribute the profits via dividends or stock redemptions. Investors will pay an additional tax when they receive their profits in their home countries. The 21% rate is today’s Corporate Tax rate and could go up in the future.

If a US company had bought the company, or it were structured as a Cayman holding company, this 21% would not be paid. To be clear, no matter what structure you choose, you are not avoiding taxes in your home countries or the countries where you operate. You continue to pay taxes operating your business in Chile, Colombia, Brazil, Mexico or anywhere you are operating, and entrepreneurs and investors will pay their own taxes in their home countries where they are tax residents.

A simplified example on a $100M sale:

| Numbers in Millions | Delaware | Cayman |

| Exit | $100 | $100 |

| Corporate Tax Rate | 21% | 0% |

| Corporate Tax Paid | $21 | $0 |

| Net Proceeds | $79 | $100 |

| Entrepreneur & Investor Tax Rate | 21% | 21% |

| Taxes Paid | $17 | $21 |

| Net Proceeds | $62 | $79 |

Hotel California: Why Latin American startups should think twice before defaulting to a Delaware C Corp

Unlike other structures, if you start as a C Corp, it’s very hard to restructure. If you want to change your Delaware C Corp to another structure, the US will force you to pay 21% corporate tax on your paper profits. You can start with another structure and move to a C Corp easily, but not the other way around. A very simplified example of C Corp tax on leaving Delaware to restructure:

| Seed Valuation | $5,000,000 |

| Delaware Tax Rate | 21% |

| Exit Tax Paid | $1,050,000 |

No startup wants to pay 21% taxes on the paper upside in valuation that an investment created. Investors don’t want their money going to paying taxes to restructure a business, especially at early stage.

Why do LatAm Companies use Delaware C Corps and expose themselves to double tax?

It’s mostly ignorance. If you talk to any US VC that’s used to investing in US companies, they will require a Delaware C Corp because they are used to investing in Delaware C Corps for US venture deals. The vast, vast majority of US venture deals are done with Delaware C Corps. Investors know how to do one type of deal.

Founders don’t know any better, most local Latin American lawyers don’t know any better. US lawyers who are not experts in Latin America don’t know any better. This is a case of continuing to follow the US rules without knowing that these rules don’t make sense in Latin America. None of the VCs, lawyers or founders are bad, stupid or trying to give bad advice. Even most VCs, myself included, didn’t know about this until we started to have exits.

Things are starting to change: Many US VCs are investing in Cayman and the UK

US investors are getting on board with the Cayman holding structure. Some are also willing to use a UK structure. A few batches ago, YCombinator started to allow companies to use Cayman holding companies:

We invest in US, Cayman, Singapore, and Canada corporations.

https://www.ycombinator.com/deal/

Many top Latin American startups are using Cayman structures, and a minority are using the UK. Some still use C Corps. Most of the top tier US VCs have invested in Cayman holding companies.

Delaware LLCs could be an alternative for pre-seed and seed Latin American Startups

You’ve probably heard that VCs won’t invest in Limited Liability Companies (LLCs). It’s generally true. But early stage LatAm founders might want to use an LLC as their first entity to preserve optionality. You can change your LLC to a C Corp, or add a Cayman or UK entity in the future, but you can’t change your C Corp without paying significant penalties. Read more about why LLCs might be good for your startup.

Why UK Companies can be a Decent Fallback for some (especially Mexican) companies

UK holding companies have many of the benefits of Cayman and multiple top tier VCs have invested in UK structures for UK, European and Latin American companies.

UK is more complex and less common than Cayman, but there may be a case to use it, especially for Mexican founders who are worried about Mexico’s extra scrutiny of Cayman companies. There is also a case for UK for companies that have corporates or corporate VCs on their cap tables. Some CVCs and corporates have prohibitions on investing in Cayman. Generally, this fear is likely overblown, but UK seems like it can be a solid choice if necessary.

The downsides of UK companies compared to Cayman:

- They’re less common than Cayman, making some VCs uncomfortable

- Your shareholder lists are public record, in Cayman they are private

- You need to pay around $2,000 to file your accounts each year. In Cayman you do not.

- There is a 0.5% stamp duty on share transfers, in Cayman there isn’t

- Corporate share buybacks are more complex, in Cayman they are easier

Avoiding the Dreaded Freeze

If you start with a C Corp and realize that you are unlikely to be bought by a US company, you can try to restructure your company using what’s called a Freeze. This creates a parallel structure with usually a Cayman holding company alongside your C Corp and tries to limit the proceeds that are subject to US Corporate tax. These freezes are extremely complex and expensive, and can cost upwards of $250,000 to structure, and then can cost $1,000,000+ to analyze at exit. You can find a more in depth overview of freezes for Latin American startups here.

Indirect Tax on Exits

Even though startups structure themselves as a C Corp, Cayman or UK company, if they have local subsidiaries, they will likely have to pay an indirect tax on the sale when the holding company is acquired.

These indirect taxes can be a surprise for many non-Latin American investors, and if handled correctly, generally don’t increase overall tax liability, just change the distribution of tax payments across multiple jurisdictions where the company operated. If done incorrectly, indirect taxes on exit can cause issues for founders and investors alike. You can read a more in depth overview of Latin American indirect tax on exits here. Be sure to check out how SAFEs and Convertible notes could lead to additional taxes on Latin American exits.

Finding Good Lawyers

Many local lawyers know the law in their home country and do a great job. The majority of them don’t have venture capital experience across borders, even if they are highly rated locally. Many good US lawyers know VC well in the US, but don’t have experience in Latin America. There are likely many good lawyers who know LatAm and the US and this is by no means an all encompassing list. Here are a few we’ve been in deals with and with worked with:

SV Firms with LatAm Expertise

We have worked with both and they do a great job. They are more expensive and can be selective on their clients. They are a good fit if you are raising $1M+ or working with a top tier fund. Don’t feel bad if they won’t take your company because you are too early stage.

Miami Firms with LatAm Expertise

- PAG – Juan Pablo Capello and Liz Flores have covered many of these issues on their LatAm List columns and the Aquí y Ahora Podcast

- Next Legal

We work with both and they do a great job. PAG and Next Legal are good options for startups, especially those that are raising pre-seed and seed and flipping from LatAm to US or Cayman. They are going to be less expensive, while still providing good, quality work.

UK Firms with LatAm Experience

Taylor Wessing – Has worked with LatAm companies that have raised significant global VC

Chile Firms with Startup Experience

PPU – They are experts in structuring from a Chilean perspective

This is by no means an exhaustive list. There are more firms that do a great job. If you’re an entrepreneur with a firm to recommend or a firm that’s worked with many LatAm founders, feel free to write me to include on the list.

Conclusion

I wrote this as a guide based on my experience as an investor. This is not legal advice. It’s not tax advice. Please do not follow it without consulting a good lawyer and accountant. Each startup and founder’s case is different and will have unique challenges and may need different structures to fit their unique set of facts. It was written in January 2021, and laws and VC behavior may change in the future.

If you have any comments, questions, additions or things I got wrong, please feel free to email me, connect via Magma Partners, or write me on Twitter and I will update this post.

This post is also available in: Español (Spanish)

4 comments

Muy interesante articulo! Hay mucho desconocimiento local en estos temas y se necesitan mas artículos así

Excelente post! Just one question. Why not just a Cayman/UK holding and latam op co, without a Delaware LLC? What’s the reason for a LLC in between?

Great advice, thanks!

Excellent post !! Glad to hear more about UK-based firms

Comments are closed.