The COVID-19 pandemic has brought to light which of our daily activities we are capable of carrying out online. Out of necessity and through the use of technology, people have found ways to socialize with friends and family, work from home, and even maintain fitness routines. This tendency is also reflected in how we perform more complex tasks like managing our finances.

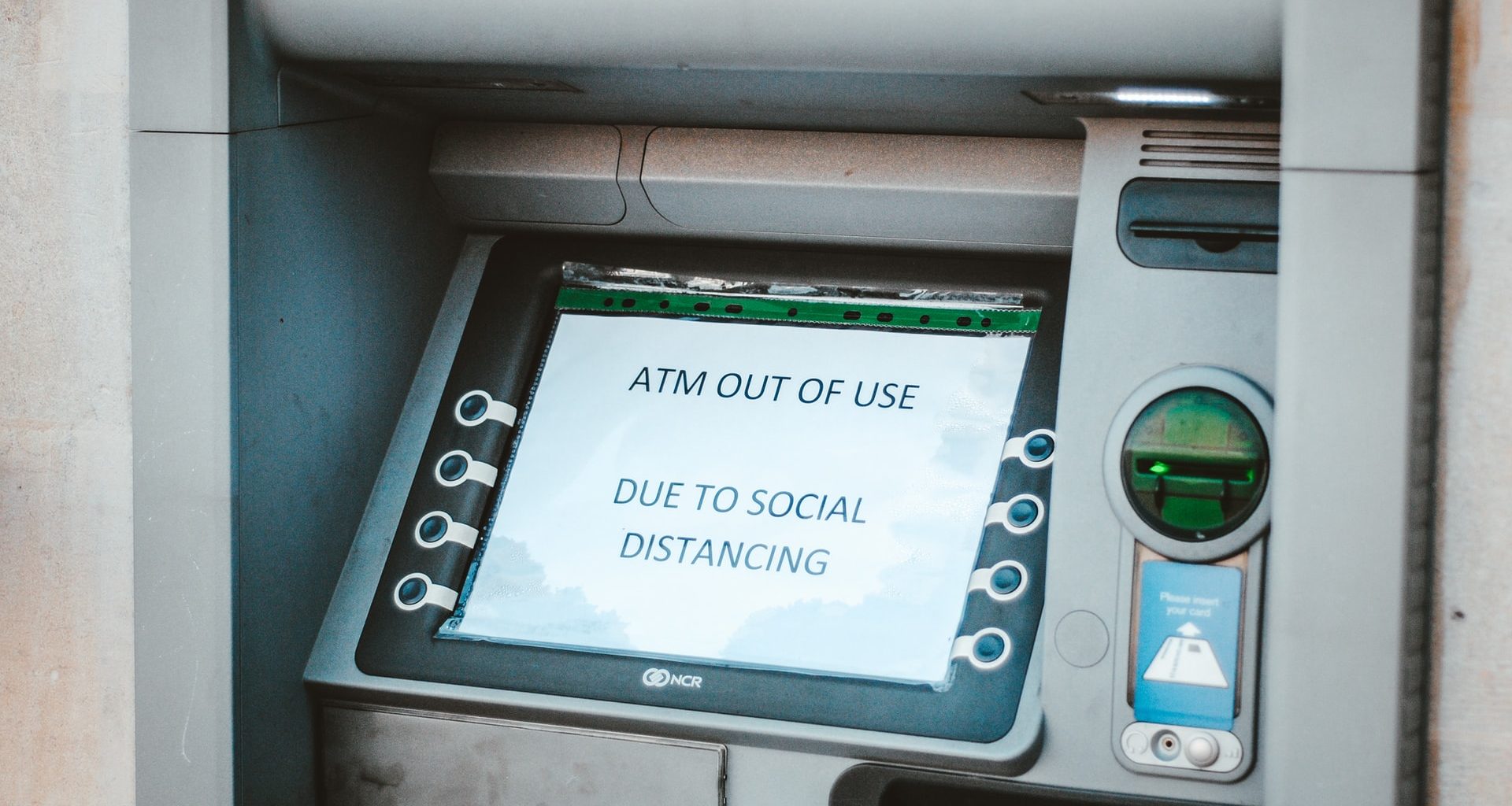

About 70% of the Latin American population is either unbanked or underbanked and there is a large preference for cash throughout the region as the main method of payment. This aspect of Latin America’s payment ecosystem can be concerning during a pandemic where reducing contact with possible transmitters –with, for example, contaminated dollar bills or ATM machines– is vital.

Therefore, the ability to offer financial services online is becoming increasingly important during the COVID-19 pandemic in order to comply with social distancing measures. However, because financial services are high-risk operations, it is crucial to communicate in a way that instills trust in the customers behind the screen. Voice technologies have tremendous potential to effectively communicate sensitive information at scale and help financial institutions initiate their digital transformation.

Voice-Driven Customer Service

One way in which financial institutions can start operating digitally is by introducing voice technologies into customer service. Bank call centers are dealing with larger call volumes since the start of the pandemic. These circumstances have generated long wait times as bank employees are stretched thin.

Financial institutions can use voice assistants to help manage customer flow and unburden their staff. For instance, Vozy’s AI-powered assistant Lili is designed to provide customer service support for both inbound and outbound calls. Lili’s technology is able to redirect clients that require attention from a human agent and help companies communicate with their clients in a more efficient way.

Oftentimes, customers are paying high banking fees but in return receive poor services from outdated technologies. However, through the use of machine learning, voice technologies are able to identify slang, different accents, and intonations which significantly speeds up interactions.

For example, Vozy’s Lili is able to understand and speak eight different Spanish accents from across Latin America (with Neural Text To Speech), creating a more personalized customer experience than other automated communications systems.

A positive experience from these initial interactions can encourage customers to trust and embrace other digital financial services.

Contactless Banking

Another possibility within the realm of voice technologies in financial services is payment through voice-controlled integrations. Although customers might need some more time getting used to voice payments, Business Insider predicts that the adoption of these types of transactions is set to grow from 8% to 31% of US adults by 2022.

Currently, the most common adoption of voice technologies in finance is for enabling banking transactions. That is, checking balances, retrieving payment information, or paying bills. Users are gradually getting comfortable with the use of financial technologies and trusting voice assistants with their financial security.

At the moment, Lili can capture real-time information on payments and be trained to help financial institutions in negotiations with debtors to pay their debts.

Fraud Prevention

With biometrics being one of the most secure methods of personal identification, those who use voice payments can use their voice to verify their identity instead of entering a PIN number when handling their finances. HSBC’s voice biometrics system has successfully blocked fraud attempts and prevented nearly $493M from being stolen by phone scammers in 2019.

Voice assistants, like Lili, can also help financial institutions protect their customers by sending alerts when unusual activity is detected in their accounts.

Voice Technologies in the Latin American Landscape

The COVID-19 pandemic has helped accelerate the digital transformation of financial services and is reshaping payment ecosystems in Latin America. There are many advances in voice technologies that are helping streamline processes and improve customer service, especially in traditional financial institutions that have to step up their game with the rise of fintechs. Despite these advances, there is still work to be done to create trust in such a risk-averse industry.